- Kelly Criterion Sports Betting Tips

- Kelly Criterion Sports Betting Calculator

- Kelly Criterion Calculator

- Kelly Criterion Sports Betting Expert

- Kelly Criterion Calculator For Sports Betting

- Kelly Criterion Sports Betting Rules

Introduction

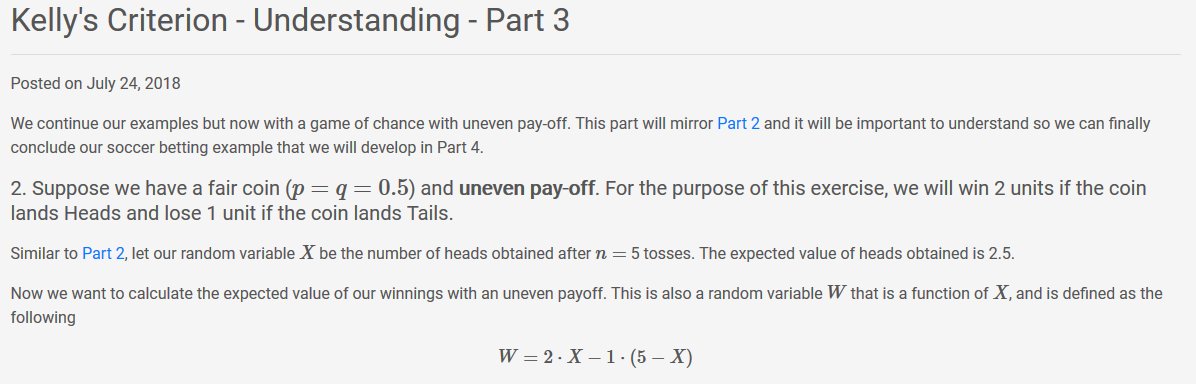

J.L.Kelly, in his seminal paper A New Interpretation of Information Rate (Bell System Technical Journal, 35, 917-926 see below) asked the interesting question: how much of my bankroll should I stake on a bet if the odds are in my favor? This is the same question that a business owner, investor, or speculator has to ask themself: what proportion of my capital should I stake on a risky venture?

Kelly did not, of course, use those precise words — the paper being written in terms of an imaginary scenario involving bookies, noisy telephone lines, and wiretaps so that it could be published by the prestigious Bell System Technical journal.

- Kelly Criterion is also referred to as Kelly strategy, Kelly formula, Kelly staking or Kelly bet. It is a formula used to determine the optimal size of a series of bets in sports or investment. The criterion is most often used in sports gambling and certain investment related scenarios. This online sports betting.

- Fractional Kelly betting is also supported. The Kelly criterion is formula that calculates the proportion of your balance to wager on a particular gamble. Learn more about the Kelly criterion.

Because the Kelly Criterion seeks to calculate the optimum stake for any value bet so as to maximise that value as well as maximise the growth of your betting bankroll.

Assuming that your criterion is the same as Kelly's criterion — maximizing the long term growth rate of your fortune — the answer Kelly gives is to stake the fraction of your gambling or investment bankroll which exactly equals your advantage. The form below allows you to determine what that amount is.

Please read the disclaimer, if you haven't done so already.

Results

The Kelly Criterion is to bet a predetermined fraction of assets, and it can seem counterintuitive. It was described by J. Kelly, Jr, a researcher at Bell Labs, in 1956. For an even money bet, the Kelly criterion computes the wager size percentage by multiplying the percent chance to win by two, then subtracting one. So, for a bet with a 70%. Jan 29, 2021 In 1956 a researcher at Bell Labs named J. Kelly created the formula that would be known as Kelly criterion. Definition of the Kelly Criterion. The Kelly Criterion tells you how much of your bankroll you should risk when betting on a certain outcome. The size of the bet depends on the offered odds and the probability of the outcome.

- The odds are in your favor, but read the following carefully:

- According to the Kelly criterion your optimal bet is about 5.71% of your capital, or $57.00.

- On 40% of similar occasions, you would expect to gain $99.75 in addition to your stake of $57.00 being returned.

- But on those occasions when you lose, you will lose your stake of $57.00.

- Your fortune will grow, on average, by about 0.28% on each bet.

- Bets have been rounded down to the nearest multiple of $1.00.

- If you do not bet exactly $57.00, you should bet less than $57.00.

- The outcome of this bet is assumed to have no relationship to any other bet you make.

- The Kelly criterion is maximally aggressive — it seeks to increase capital at the maximum rate possible. Professional gamblers typically take a less aggressive approach, and generally won't bet more than about 2.5% of their bankroll on any wager. In this case that would be $25.00.

- A common strategy (see discussion below) is to wager half the Kelly amount, which in this case would be $28.00.

- If your estimated probability of 40% is too high, you will bet too much and lose over time. Make sure you are using a conservative (low) estimate.

- Please read the disclaimer as well as the notes below.

More Information

The BJ Math site used to contain a great collection of papers on Kelly betting, including the original Kelly Bell Technical System Journal paper. Unfortunately it is now defunct, and only contains adverts for an online casino. However, you can find much of the content through the Wayback Machine archive. The Internet Archive also contains a copy of Kelly's original paper which appeared as A New Interpretation of Information Rate, Bell System Technical Journal, Vol. 35, pp917-926, July 1956. (If this link breaks — as it has done several time since this page was written — try searching for the article title).

We based the above calculations on the description given in the book Taking Chances: Winning With Probability by John Haigh, which is an excellent introduction to the mathematics of probability. (Note that there is a misprint in the formula for approximating average growth rate on p359 (2nd edition) and the approximation also assumes that your advantage is small. There is a short list of corrections which can be found through John Haigh's web page).

Note that although the Kelly Criterion provides an upper bound on the amount that should be risked, there are sound arguments for risking less. In particular, the Kelly fraction assumes an infinitely long sequence of wagers — but in the long run we are all dead. It can be shown that a Kelly bettor has a 1/3 chance of halving a bankroll before doubling it, and that you have a 1/n chance or reducing your bankroll to 1/n at some point in the future. For comparison, a “half kelly” bettor only has a 1/9 chance of halving their bankroll before doubling it. There's an interesting discussion of this (not aimed at a mathematical reader) in Part 4 of the book Fortune's Formula which gives some of the history of the Kelly criterion, along with some of its notable successes and failures.

Jeffrey Ma was one of the members of the MIT Blackjack Team, a team which developed a system based on the Kelly criterion, card counting, and team play to beat casinos at Blackjack. He has written an interesting book The House Advantage, which examines what he learned about managing risk from playing blackjack. (He also covers some of the measures put in place by casinos to prevent the team winning!)

See also: suggested books on probability and statistics and suggested books on investment and automated trading.

Disclaimer

The Kelly Strategy Bet Calculator is intended for interest only. We don't recommend that you gamble.We don't recommend that you place any bets based upon the results displayed here. We don't guarantee the results. Use entirely at your own risk.

The Kelly Calculator (or Kelly Criterion Calculator) can help a sports bettor decide how much of their bankroll to risk on a wager. The amount recommended is based on the odds offered by the sportsbook as well as an understanding of your predicted winning percentage.

Originally applied to the stock market, the Kelly Calculator quickly moved to horse betting and found its most successful use in poker. But this aggressive betting strategy can be used with any form of wagering to maximize profit based on the information at hand.

Kelly Calculator

Try out the Kelly Criterion Calculator below, but pay careful attention to sure things (like -200 odds or above) because that is where Kelly can get you in trouble.

What Is A Kelly Criterion Calculator?

A Kelly Criterion Calculator helps you decide what percentage of your bankroll you should wager on a sports bet. So you first need to decide your bankroll size and the length of time you’ll be using the Kelly method.

The easiest is to say you’ll be using the Kelly Criterion for one year or the length of a sports season. A timeframe is important because the goal of the Kelly Calculator is to profit over a given period. Once that time has elapsed, you can see your profit percentage, then adjust your Kelly Criterion approach accordingly.

You’ll also want a good idea of your win percentage. But if you’re exclusively a -110 bettor, the minimum win percentage is 53% for the Kelly Calculator to recommend betting any amount.

If your win percentage is lower than 53% on -110 wagers but you still want to use the Kelly Criterion, you’ll need to look for bets with longer odds (or bets that you think would have a higher win percentage).

How To Use A Kelly Criterion Calculator To Place A Sports Bet

To use the Kelly Calculator for sports betting, you need a few pieces of information. The odds, of course, but then you also need your winning percentage. Unfortunately, this is where some go wrong.

You need the winning percentage of the specific odds you are betting on. If you put in your overall winning percentage, you are in trouble.

Imagine that you are a 55% winning sports bettor at -110 odds. Good for you! But if you put that 55% in the Kelly calculator on a +150 dog, Kelly will advise you a ridiculous 25% of your bankroll because it is looking to maximize your profit. If you put that much into a single bet, you risk losing an enormous amount of your bankroll.

Instead, you want to be as conservative as possible. If your win percentage is already 45% or lower, then just use that. But if it’s higher than 50%, you want to be realistic when you’re betting on odds longer than -110.

Kelly Multiplier

You also need to decide the Kelly Multiplier you’re going to use. Basically, this is how much of the Kelly Calculator recommended amount you want to wager. While the calculator is automatically set at 1, we recommend adjusting it to no more than 0.5 for long-term betting.

Most bettors apply a factor to the Kelly calculator (the Kelly multiplier) to take advantage of the theory’s betting advice while limiting risk. This means a much less aggressive potential growth while keeping the volatility down by a significantly lower margin.

You Can Never Guarantee A Profit

There is a huge drawback that you must understand and be aware of before using Kelly Criterion in your betting. The catch is always the win percentage. In sports betting, as with investing, your personal win percentage at different odds is virtually impossible to get accurate. And if it’s not accurate, the volatility in your betting will evaporate your bankroll.

So approach this knowing that you can never assure that you’ll make a profit.

But if you are a strict -110 bettor, then, over time, Kelly Criterion can help give you the ideal betting outcome.

Looking for other calculators to use when sports betting? Check out:

How The Kelly Criterion Calculator Math Works

While you can simply enter the information into the Gaming Today online Kelly Calculator, it can be helpful to know how the math works. Here’s a step-by-step guide.

Step 1: Convert Odds To Decimal

The easiest way to convert American odds to Decimal would be to use the Odds Calculator. But it can also be done manually.

To convert positive odds, the equation is:

(Odds divided by 100) + 1

Kelly Criterion Sports Betting Tips

To convert negative odds, the equation is:

(100 divided by odds) + 1

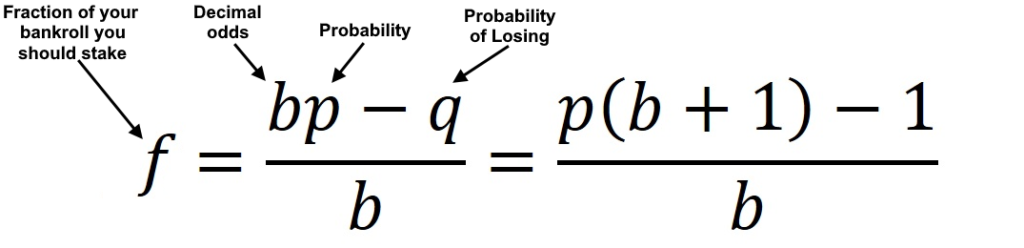

Step 2: Use The Kelly Criterion Formula

This long but easy formula is how the Kelly Calculator creates its results:

((Decimal Odds – 1) * Decimal Winning Percentage – (1 – Winning Percentage)) / (Decimal Odds – 1) * Kelly Multiplier

Kelly Criterion Example

Let’s take the basic case of -110 odds and a winning percentage of 55% with 0.5 Kelly multiplier, which is also known as a half Kelly. While it’s not the simplest situation, it’s one of the most likely scenarios when utilizing this betting strategy.

So let’s add a bit of simplicity and say that your bankroll is $1,000. That way, we can do the math and see exactly how much you would wager in this scenario.

Step 1: Converting -110 American Odds To Decimal Odds

Because it’s a negative number, you’ll use the equation (100 divided by odds) + 1 = decimal odds. 100 divided by 110 is 0.9091. Plus one, and you get 1.9091 for the decimal odds. Here it is another way:

(100/110) + 1 = 1.9091

Kelly Criterion Sports Betting Calculator

Step 2: Plugging Decimal Odds Into The Kelly Criterion Formula

With 1.9091 decimal odds, a 55% winning percentage as a decimal (0.55), and a half Kelly (0.5), the equation would look like this:

((1.9091 – 1) * 0.55 – (1 – 0.55)) / (1.9091 – 1) * 0.5 = 0.0275 (2.75%)

Kelly Criterion Calculator

If we do the math in the parentheticals first, it would be:

Kelly Criterion Sports Betting Expert

(0.9091 * 0.55 – 0.45) / 0.9091 * 0.5 = 0.0275 (2.75%)

Kelly Criterion Calculator For Sports Betting

Broken down again:

0.050005/0.9091 = 0.0550049499505 * 0.5 = 0.0275 (2.75%)

Kelly Criterion Sports Betting Rules

Using the Kelly Criterion, you should use 2.75% of your $1,000 bankroll, or $27.50. Good luck!